The Most Exclusive And The Elite Credits Cards In Dubai For The Year 2025

The most useful and versatile item that you can carry in your wallet is a credit card. A small but very useful item that is no less than any power gadget. As a financial gadget and management tool, credit cards offer a wide range of benefits, i.e., different rewards and many promotional offers on different international and local brands.

In this blog, you will learn about different standard and elite credit cards in Dubai. After having the complete details, you can choose one according to your requirements and preferences. Although all credit cards are not the same, as some are designed for the elite class, some are for everyone, and a few cards do possess an exclusive nature.

Each credit card has its own secrecy and is cloaked under many appealing prerequisites and unaltered rewards as well. So, to get the best reward, you must have complete knowledge about the best and most exclusive credit cards in Dubai.

The Top 5 Most Exclusive Credit Cards In Dubai

Here in this blog, we are going to tell you about the top and most exclusive types of credit cards that have been used for many years and are considered the best for the year 2025, not only in Dubai but in the entire United Arab Emirates as well. Let us have a quick look at the names of these elite credit cards in Dubai.

- Citi Simplicity Card

- ADCB Islamic – TouchPoints Infinite Card

- Dubai Islamic Bank – The Emirates Skywards DIB Platinum Credit Card

- The American Express – The Platinum Card (Amex)

- JP Morgan Chase Reserve Card

These cards result from our top-class research and are the best and most exclusive credit cards ever for the users of Dubai. All of them come up with their own details, benefits, and offers that are undeniable for every person. So let us have a glance at the details and brief descriptions of each credit card one by one.

Standard Credit Cards

The first 3 cards that are mentioned in the above list are standard cards that provide you with an entry into the world of credit cards if you are a beginner or cannot afford an expensive one.

These elite credit cards in Dubai are designed by different banks in the country in order to give an entry into this field and are specially dedicated for beginners with a small salary. If you are a beginner, then the standard cards would be a splendid choice for you. The details are.

1. Citi Simplicity Card

General Information

| Minimum Salary | AED 5,000 |

| Annual Fee | AED 0 |

| Rate | 3.5% |

| Salary Transfer | No |

If you are in search of a card that can offer you a simple entry, then you must consider Citi Bank’s Simplicity card. If you are earning about 5K per month, then you can easily get this card. The card has a very simple policy and doesn’t charge any annual fee either. Besides, it also does not charge with late payments.

Features

Some of the major features that you can enjoy instantly after getting this card are mentioned below.

- Vouchers

- Discounts

- Airport Lounge Access

- Free Supplementary Cards

- Offers

- Balance Transfer

Additional Benefits

You can enjoy a lot of features after purchasing this standard card offered by Citi Bank in Dubai. Some of the highest-rated and most appreciated features of this card are:

- There are no late payment charges.

- You do not have to pay an annual fee.

- You can access the Airport Lounges around the entire Middle East.

- By using PayLite, you can easily turn any huge purchase into a small payment.

- In almost 95 countries, you can enjoy discounts on dining, entertainment, and traveling.

- Get complimentary cards for the members of your family.

2. ADCB Islamic – TouchPoints Infinite Card

General Information

| Minimum Salary | AED 0 |

| Annual Fee | AED 1,050 |

| Rate | 3.25% |

| Salary Transfer | No |

For those people who are excited to enjoy traveling and other entertainment activities around the globe, this card is no less than a blessing for them. There are no salary restrictions for getting this card, and it offers heavy discounts at different dining or entertainment places. You can also enjoy discounted travel expenses by using this ADCB Islamic TouchPoints Infinite Card.

Features

The most amazing features of this ADCB Islamic TouchPoints Infinite credit card will blow your mind. These characteristics are given as follows.

- Vouchers

- Balance Offers

- Discounts

- Offers

Additional Benefits

As we have mentioned earlier, this card is a good choice for people who do not have any permanent salary and want to explore the world by availing different discount offers on travel and other visiting spots as well. So let us have a look at some irresistible features of this card.

- After purchasing this card, you can get a complimentary stay for 2 nights at any place in the world.

- By Emaar Platinum Tier Membership, avail complimentary U.

- While purchasing coffee, buy 1 get one free offer.

- On Talabat orders, 20% is off.

- For Careem weekend rides, enjoy 50% off.

- Enjoy 15% off at Noon.com

- Different discount offers on Yas islands theme parks.

- Complimentary access to the golf clubs.

- Two-for-one deals.

- International Concierge

- Pay order benefits.

- Installments plans.

- Balance transfers.

3. Dubai Islamic Bank – The Emirates Skywards DIB Platinum Credit Card

General Information

| Minimum Salary | AED 5,000 |

| Annual Fee | AED 525 |

| Rate | 3% |

| Salary Transfer | No |

This card is also present in the category of standard cards and offers a wide range of different facilities, including sharia-compliant features as well. These cards are considered the perfect companion during your travels and stay at different hotels too. Let’s have a detailed look at the facilities provided by this card.

Features

The value and worth of any card are determined completely by the basic facilities and features. The most prominent features that are offered by this Dubai Islamic Bank-The Emirates Skywards DIB Platinum Credit Card are mentioned below.

- Vouchers

- Offers

- Discounts

- Sharia Compliant

- Balance Transfer

- Islamic Finance

Additional Benefits

The major benefits you can get after purchasing this card from Dubai Islamic Bank are described briefly here in our blogs so that you can get an eloquent and detailed understanding of this credit card.

- Earn Skywards Miles Bonus.

- Different dining offers.

- From the collection of Visa, you can enjoy Luxury Hotels as well.

- The facility of transferring the balance.

- Legal and medical referral.

- Purchase protection for all 365 days a year.

- International customer assistance services.

- Visa payWave.

- Extended Warranty.

- Pin and Chip security.

- Withdrawal of Cash

- Discount offers.

Elite Credit Cards

The cards that fall under the elite category are the ones that require a capital amount of investment or demand a white-collar job. These types of elite-class credit cards do not require any kind of restrictions and offer exceptional services, facilities, and benefits to the rich.

Here in our list, we have stated about 2 elite cards. Let us discuss them one by one and get complete details about these elite credit cards in Dubai.

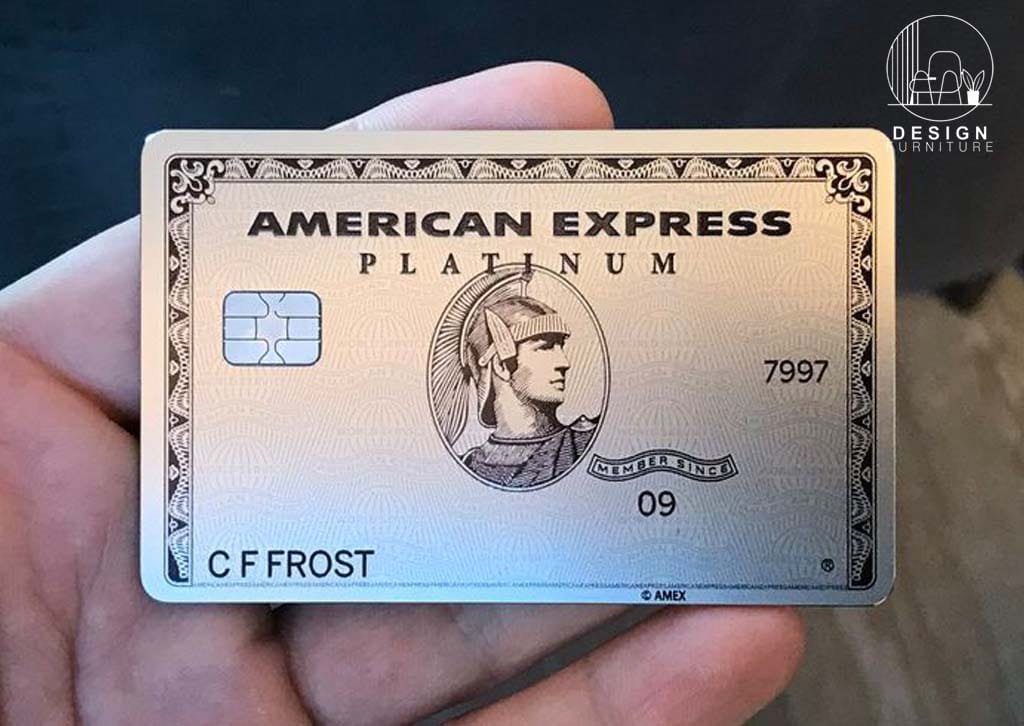

4. The American Express – The Platinum Card (Amex 20)

General Information

| Minimum Salary | AED 30,700 |

| Annual Fee | AED 2,754 |

| Rate | 0% |

| Salary Transfer | No |

This credit comes under the category of elite cards and offers you a lot of perks that can alter your lifestyle as well. If you want an overall classical experience during your dining, traveling, or staying at any place, then this card is going to be very helpful for you.

Besides these features, you can also enjoy some complimentary facilities that no one else provides except American Express. So let us have a look at some of the major things that an Amex 20 card offers.

Features

After getting this elite card, you can enjoy a lot of features, but some basic and worthwhile characteristics of the American Express-The Platinum Card (Amex 20) are enlisted below.

- Vouchers

- Discounts

- Offers

- Airport Lounge Access

- Air Miles

- No transfer of salary

Additional Benefits

Besides obtaining the above basic features, this card also offers a complete list of different plus points that cannot be neglected at all. You can get a lot more benefits and some of the highly irresistible advantages of the American Express Platinum card (Amex 20) are listed here.

- You can receive a travel credit of AED 1,100 or 300 USD annually.

- Enjoy the complimentary Wi-Fi facilities provided by Boingo.

- Over 1,200 airport lounges worldwide will provide complimentary priority Pass TM enrollment to supplementary and even basic card members.

- Dedicated Concierge Services and Platinum Travel Services are offered 24/7.

- Membership rewards on complimentary enrolment.

- Get detailed travel insurance.

- Loyalty programs offered by different luxury hotels can also be enrolled in.

5. JP Morgan Chase Reserve Card

General Information

| Minimum Salary | AED 0 |

| Annual Fee | AED 2,185 |

| Rate | 0% |

| Salary Transfer | No |

If you are a millionaire and have got a minimum amount of about 10 million dollars but are not sure where to spend it, then this Chase Reserve card is of your interest. You only have to pay your money to JP Morgan.

They invest the money in some assets that are non-real estate. After giving your money to them in return, you will get a JP Morgan Chase Reverse Credit Card. The overall benefits of this elite credit card are dedicated to millionaires and the elite class community of society. Let us discuss some basic features of this card.

Features

This JP Morgan Chase Reverse card is the choice of millionaires, so this card is expensive and will show some elite features as it falls under the category of elite credit cards in Dubai. The basic features of this credit card are discussed below.

- The card is plated with palladium.

- The JP Morgan Chase reverse card is five times heavier than a standard credit card.

- Traveling benefits.

- Lounge facilities.